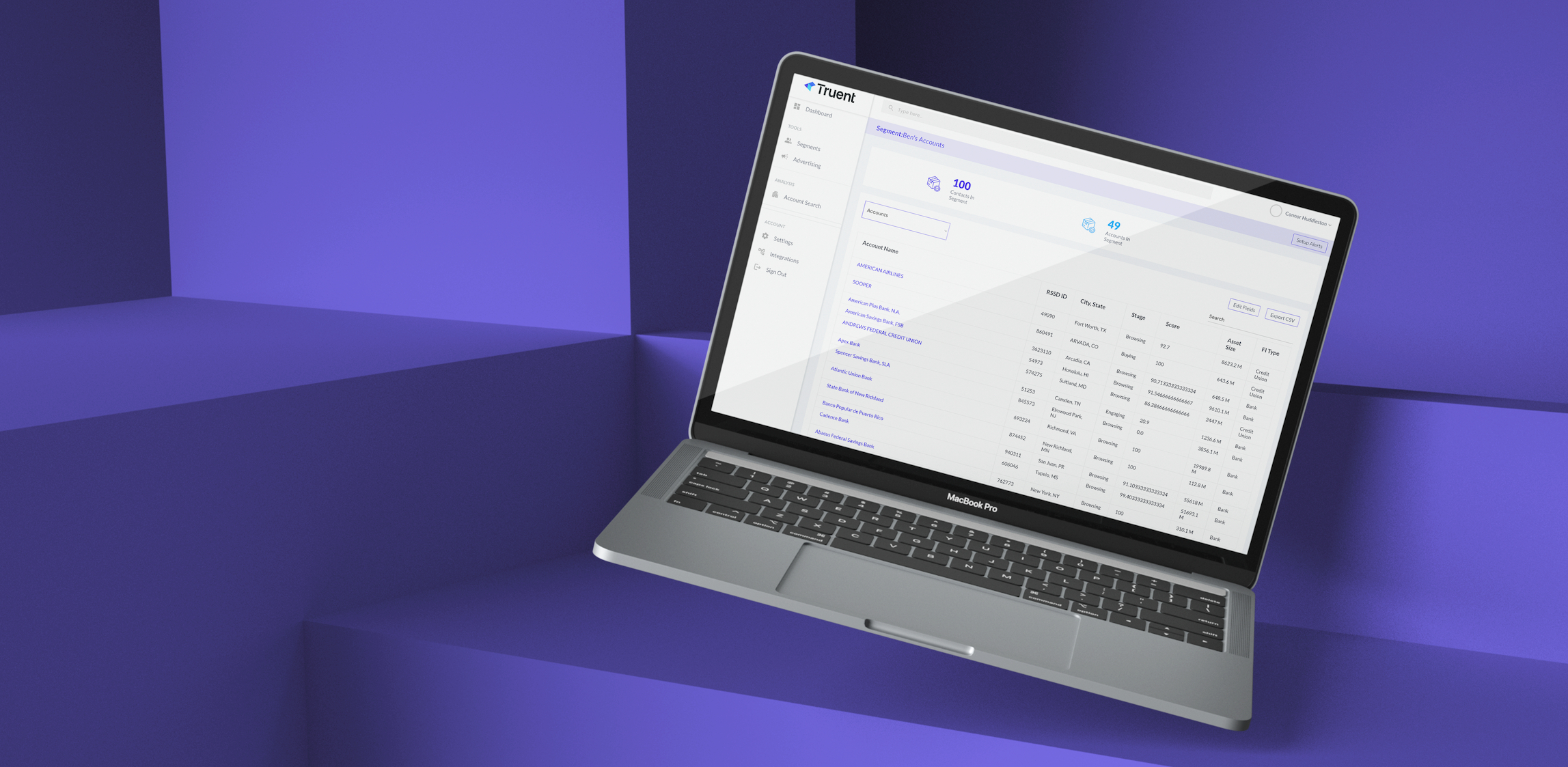

Truent.ai seeks to improve the way businesses identify and connect with financial institutions to create, convert and retain revenue. The company’s Verified Intent Platform captures signals from verified financial institution employees to deliver true intent that intends to increase pipeline, sales velocity and efficiency. According to Truent, using data collected and attributed to an identified source provides the highest level of accuracy and eliminates the risk of false positives generated from anonymous signals. The company’s suite of tools helps enable sales, marketing and customer success teams to reach financial institutions at the moment of need in a manner that aligns with the unique buying behaviors of regulated businesses.

The Lowdown

Truent.ai’s new Segmentation & Alerts feature is designed to enhance revenue intelligence for businesses selling to banks and financial institutions. It leverages AI to analyze 23 firmographic and intent data points, providing insights into the unique buying behaviors of financial institutions. This reportedly enables go-to-market (GTM) teams to personalize outreach efficiently, eliminating outdated strategies and optimizing resources for effective targeting within the financial industry. Truent.ai aims to support strategic initiatives and sustain growth by delivering a tailored experience for its customers in the evolving revenue operations landscape.

Back-Of-The-Box Details

Truent.ai’s new product feature identifies a prospect’s likelihood to purchase a product via 23 different firmographic and intent data points specific to financial institution, which includes the institution’s core offerings, asset size, location, number of branches and more. With these data points, teams can pinpoint exactly where and how prospective customers within the financial industry are looking to purchase. This eliminates inefficiency and outdated GTM strategies that are focused on generating massive amounts of activities, which ultimately waste significant human resources and valuable company dollars.

Who It’s For

Truent.ai is built specifically for those selling into the banking and credit union market, providing a concise and accurate view of an ideal customer profile. Truent’s seeks to deliver the experience and support customers need to implement strategic GTM initiatives that cater to the financial industry. Truent claims it’s committed to partnering with customers and providing them with the critical resources and support they need to navigate an evolving revenue operations landscape.

What It Solves

Despite increasing optimism that the U.S.’s economy will achieve a soft landing, GTM teams are still being asked to do more with less. As a result, identifying and adopting AI-powered solutions to drive efficiencies and enable scaled 1:1 outreach is critical for success, particularly in relationship-driven industries like banking and financial services. Segmentation & Alerts helps GTM teams selling to U.S.-based banks and credit unions achieve this level of personalization by specifically providing insights into the unique buying behaviors of financial institutions.

What Makes It Special

According to the company, Segmentation & Alerts is the first and only solution of its kind specifically geared toward empowering GTM teams selling to financial institutions.